seguros state farm sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This well-established insurance provider has been a trusted name in the industry for decades, providing a variety of coverage options tailored to meet the diverse needs of its customers. With a commitment to customer satisfaction and a strong market presence, State Farm stands out as a leader among insurers.

Overview of State Farm Insurance

State Farm Insurance has established itself as a cornerstone of the American insurance landscape since its founding in 1922. Originating as a mutual automobile insurance company aimed at providing affordable coverage to farmers, State Farm has evolved into one of the largest providers of insurance products in the nation. With a commitment to serving its policyholders, the company has expanded its offerings across various domains, ensuring that it meets the diverse needs of its customers.

The range of insurance products available from State Farm encompasses a variety of options designed to protect individuals, families, and businesses. Key offerings include auto insurance, home insurance, renters insurance, life insurance, health insurance, and business insurance. This broad spectrum of services allows State Farm to cater to a wide audience, providing tailored solutions that fit different lifestyles and circumstances.

Insurance Types Offered by State Farm, Seguros state farm

State Farm’s extensive portfolio includes several key insurance types, each addressing specific protection needs. The company stands out in the following areas:

- Auto Insurance: Provides coverage for cars, trucks, and motorcycles, with options for liability, comprehensive, and collision coverage.

- Home Insurance: Offers protection for homeowners against losses from damages, theft, and liability claims, with various policy options to meet individual needs.

- Renters Insurance: Protects tenants from personal property loss and liability, offering affordable solutions for non-homeowners.

- Life Insurance: Includes term, whole, and universal life policies that provide financial security for beneficiaries in the event of the policyholder’s passing.

- Health Insurance: Provides coverage for medical expenses, including various plans such as individual and family health policies.

- Business Insurance: Offers solutions for small businesses, including liability, property, and worker’s compensation insurance.

State Farm’s market presence is significant, making it a leader in the insurance industry. According to recent statistics, State Farm insures approximately 1 in 5 vehicles in the United States, which translates to over 40 million auto insurance policies. The company also boasts a customer satisfaction rating that consistently ranks above the industry average, reflecting its dedication to providing quality service and reliable coverage.

“The company’s mission is to help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.”

Benefits of Choosing State Farm Insurance

Selecting the right insurance provider is crucial in ensuring peace of mind and financial security. State Farm Insurance stands out in the crowded insurance marketplace with its extensive range of benefits designed to meet diverse customer needs. By choosing State Farm, clients gain access to unique features that not only enhance their insurance experience but also provide comprehensive support when needed the most.

One of the primary advantages of selecting State Farm is its robust network of agents and customer service representatives. Their commitment to personalized service has made them a trusted choice for millions. With over 19,000 agents across the United States, customers have the opportunity to receive tailored advice and assistance when navigating their insurance options.

Customer Service Features

State Farm’s customer service approach distinguishes it from many competitors. The organization emphasizes accessibility and responsiveness, ensuring that clients can easily connect with knowledgeable representatives. Here are some notable customer service features:

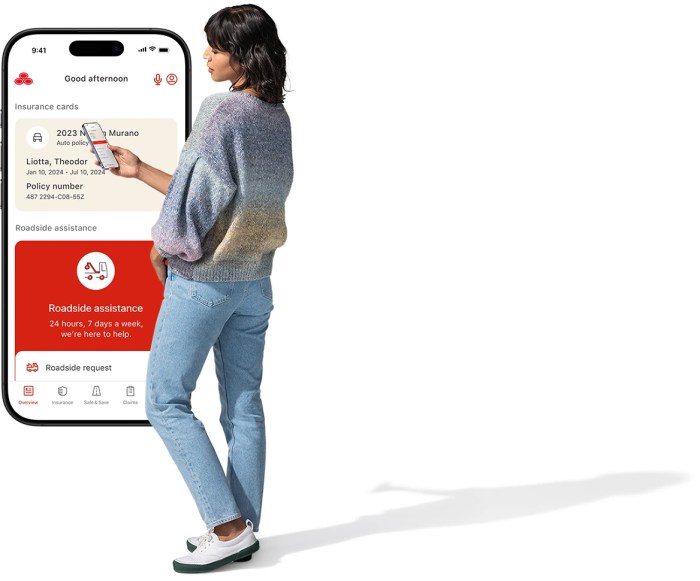

- 24/7 Availability: State Farm offers round-the-clock support through its call center and mobile app, allowing customers to get assistance any time of the day or night.

- Local Agents: Clients can work with local agents who understand their unique needs and community, fostering a personalized approach to insurance.

- Online Tools: The State Farm website and mobile app provide easy access to policy information, claims filing, and billing, ensuring customers have the resources they need at their fingertips.

- Claims Process: State Farm features a streamlined claims process, with the option for customers to manage claims online or through the app, making the experience more efficient.

The combination of these features creates a supportive environment for clients, allowing them to feel valued and heard.

“State Farm made my claims process so easy, and my agent was always just a call away.” – Sarah J., satisfied customer.

To illustrate the benefits of State Farm further, testimonials from satisfied customers highlight the effectiveness of their services. One happy policyholder, John D., shared, “When I had an accident, my State Farm agent was incredibly helpful, guiding me through every step of the claims process. I felt reassured knowing I had someone looking out for me.”

Another client, Lisa M., remarked, “I appreciate the local touch that my State Farm agent provides. They understand my needs and are always available to answer my questions, which makes a significant difference.” Through these testimonials, it’s clear that State Farm not only provides insurance products but also cultivates lasting relationships with its customers.

Types of Policies Offered by State Farm

State Farm provides a diverse range of insurance policies tailored to meet various personal and business needs. These policies not only offer essential coverage but also come with customizable options to ensure that clients can find a solution that fits their specific circumstances. By understanding the different types of coverage available, consumers can make informed decisions regarding their insurance needs.

State Farm’s offerings include several key categories, each designed to cover unique aspects of life and property. Below are the main types of insurance policies available through State Farm, along with detailed coverage options for each type.

Auto Insurance

State Farm’s auto insurance provides comprehensive protection for drivers, ensuring peace of mind on the road. The coverage options available include:

- Liability Coverage: This is mandatory in most states and covers damages to other vehicles and medical expenses if you are at fault in an accident.

- Collision Coverage: This covers the cost of repairs to your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: This protects against damages to your car from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Protection: This provides coverage if you’re in an accident with a driver who lacks adequate insurance.

- Personal Injury Protection (PIP): This offers medical expense coverage for you and your passengers after an accident, regardless of fault.

Homeowners Insurance

Homeowners insurance from State Farm safeguards your home and personal belongings. Policies typically cover:

- Dwelling Coverage: Protects the structure of your home from covered perils like fire, theft, or storm damage.

- Personal Property Coverage: Covers personal items within your home, such as furniture and electronics, against loss or damage.

- Liability Protection: Provides financial protection if someone is injured on your property and you are found liable.

- Additional Living Expenses: Covers costs incurred if you have to temporarily live elsewhere due to a home disaster.

Life Insurance

State Farm provides life insurance policies designed to protect loved ones financially in the event of the policyholder’s passing. The main options include:

- Term Life Insurance: Offers coverage for a specific period, providing a death benefit if the insured passes away during the term.

- Whole Life Insurance: A permanent policy that provides lifelong coverage and also accumulates cash value over time.

- Universal Life Insurance: A flexible policy that combines a death benefit with a savings component, allowing adjustments in premiums and coverage amounts.

Comparison with Other Insurers

When comparing State Farm’s policies with those of other major insurers, several distinctions become evident. For instance, while many competitors like Geico and Progressive focus heavily on auto insurance, State Farm offers a more comprehensive suite that includes robust homeowners and life insurance options.

In terms of pricing, State Farm generally provides competitive rates, particularly for multi-policy discounts, which can reduce overall premiums significantly. Many customers find that bundling auto and home insurance with State Farm leads to better savings compared to purchasing them separately from different providers.

State Farm’s emphasis on personalized service and local agents fosters a sense of community, often making them a preferred choice for customers seeking tailored insurance solutions.

Overall, State Farm’s extensive policy offerings and coverages position it as a formidable player in the insurance market, providing clients with versatile and reliable options to protect their assets and loved ones.

How to File a Claim with State Farm

Filing a claim with State Farm is a crucial step in ensuring that you receive the support you need after an incident. Understanding the claims process can make this often daunting task more manageable. Here is a detailed guide on how to effectively file a claim with State Farm, from initial steps to overcoming common challenges.

The claims process at State Farm is designed to be user-friendly, allowing policyholders to report losses and seek compensation efficiently. This process is streamlined through various methods, including online, mobile app, and phone options. Below is a clear step-by-step Artikel of how to file a claim.

Step-by-Step Process for Filing a Claim

To successfully file a claim with State Farm, follow these steps:

- Gather Necessary Information: Before initiating a claim, collect all pertinent details, including your policy number, the date of the incident, a description of what happened, and any supporting documents or images.

- Choose Your Filing Method: Decide how you want to file your claim. Options include:

- Online through the State Farm website

- Using the State Farm mobile app

- Calling the claims hotline directly

- Provide Detailed Information: Fill out the necessary forms or provide information over the phone. Be as detailed and accurate as possible to avoid delays.

- Submit Your Claim: Once you have completed all required fields, submit your claim. Ensure you receive a confirmation of submission.

- Follow Up: After submission, you can track the status of your claim through the State Farm website or app. Stay in contact with your claims representative for updates.

Common Challenges in the Claims Process

Navigating the claims process can present various challenges. Some policyholders may face difficulties such as unclear communication, delayed responses, or discrepancies in coverage. Recognizing these issues can help you prepare for and mitigate potential setbacks during your claim.

Clear communication with your claims representative is key to overcoming challenges.

To address common challenges, consider the following strategies:

- Maintain Clear Communication: Keep a record of all communications with State Farm representatives, including dates, names, and details of discussions.

- Be Persistent: If you encounter delays, do not hesitate to follow up regularly. Consistency can help expedite your claim.

- Understand Your Policy: Familiarize yourself with your insurance policy to clarify covered damages and claim limits, which can help in negotiations.

- Seek Assistance if Needed: If you feel overwhelmed, consider hiring a public adjuster or consulting with an insurance advocate for guidance.

Visualization of the Claims Process

To aid in understanding, envisioning the claims process can be incredibly helpful. A flowchart can depict the pathway from incident occurrence to claim resolution.

Imagine a flowchart that starts with “Incident Occurs”, leading to “Gather Information”, followed by branches for “File Claim Online”, “Use Mobile App”, or “Call Hotline”. Each of these branches leads to the “Submit Claim” step, and finally, to “Track Claim Status”.

This visual representation helps clarify each step and can serve as a quick reference guide for policyholders as they navigate their claims.

FAQ Explained: Seguros State Farm

What types of insurance does State Farm offer?

State Farm offers a variety of insurance types, including auto, home, renters, life, and health insurance.

How do I file a claim with State Farm?

You can file a claim through the State Farm website, mobile app, or by calling their claims department directly.

What are the customer service hours for State Farm?

State Farm’s customer service is available 24/7, providing assistance whenever you need it.

Can I get a quote online?

Yes, you can easily get a quote online through the State Farm website by entering your information.

Are discounts available for multiple policies?

Yes, State Farm offers discounts for bundling multiple policies, which can help you save on your premiums.

You also can understand valuable knowledge by exploring best insurance companies.

Further details about friguey insurance is accessible to provide you additional insights.